Bank of Baroda charges IMPS fees based on the slabs set by the bank. The charges for IMPS transactions vary depending on the transfer amount and are subject to change by the bank.

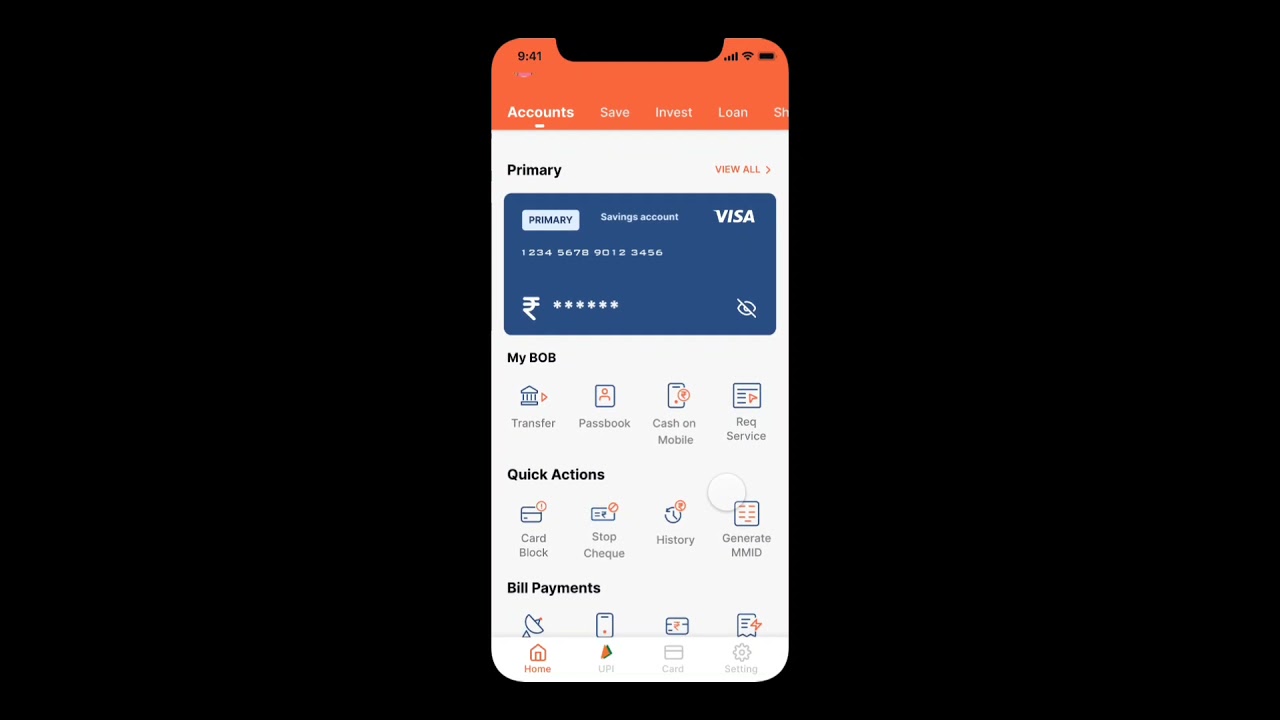

Bank of Baroda, one of the leading banks in India, offers its customers the convenience of IMPS (Immediate Payment Service) for quick and hassle-free fund transfers. Whether you need to pay bills or transfer money to another account, IMPS allows you to do it instantly.

However, it is important to be aware of the charges associated with IMPS transactions. In line with other banks, Bank of Baroda levies IMPS charges based on predefined slabs. The fees may vary based on the transfer amount, and it is recommended to check with the bank for the most up-to-date charges. This article will delve into the details of Bank of Baroda’s IMPS charges and provide essential information to help you make informed decisions when using this service.

Different Types Of Mobile Transactions

Different types of mobile transactions include P2P transfers, bill payments, and online shopping. With P2P transfers, you can easily send money to friends or family members using your mobile device. Bill payments can be conveniently made through mobile banking, saving you time and effort.

And when it comes to online shopping, mobile transactions provide a seamless experience, allowing you to make purchases from anywhere. Bank of Baroda offers competitive Imps charges for these mobile transactions, making it a cost-effective choice. Whether you need to send money, pay bills, or shop online, Bank of Baroda’s mobile banking services have got you covered.

Start enjoying the convenience and ease of mobile transactions today!

Impact Of Transaction Amount On Bank Of Baroda Imps Charges

The Bank of Baroda charges for IMPS transactions vary depending on the transaction amount. Low-value transactions incur lower charges compared to high-value transactions. The fees levied by the bank are designed to reflect the value of the transfer being made.

This means that the charges will be higher for larger sums of money being transferred through IMPS. It is important to keep this in mind when conducting transactions through Bank of Baroda, as the charges may affect your overall cost.

By understanding the impact of the transaction amount on Bank of Baroda IMPS charges, you can make informed decisions and plan your finances accordingly.

Time And Date Considerations Affecting Bank Of Baroda Imps Charges

Bank of Baroda Imps Charges vary based on time and date. The peak and off-peak hours play a significant role in determining the fees. During peak hours, such as after office hours, the charges may be higher due to increased demand.

On the other hand, during off-peak hours, especially late at night or early in the morning, the charges may be comparatively lower. Additionally, Bank of Baroda also considers the day of the week when calculating the Imps charges. Weekday charges might be higher than weekend charges as weekdays usually witness higher transaction volumes.

Therefore, it is crucial to keep these time and date considerations in mind to have a better understanding of the Bank of Baroda Imps Charges and plan your transactions accordingly.

Credit: bootcamp.uxdesign.cc

Choosing The Most Cost-Effective Mobile Transaction Methods

Bank of Baroda offers various mobile transaction methods with different charges. To choose the most cost-effective method, it is crucial to compare UPI, NEFT, and IMPS. UPI, or Unified Payments Interface, allows instant fund transfer using a mobile number linked to a bank account.

NEFT, or National Electronic Funds Transfer, facilitates online money transfers in batches. IMPS, or Immediate Payment Service, enables instant fund transfers 24/7, including weekends and holidays. Each method has its own charges, and it is essential to consider the transaction fees, convenience, and speed.

By evaluating your payment requirements and comparing the charges of UPI, NEFT, and IMPS, you can select the most suitable mobile transaction method for your needs.

Utilizing Bank Of Baroda Imps Charges Waivers And Discounts

Bank of Baroda is offering waivers and discounts on Imps charges, making it advantageous for frequent users. These offers include seasonal promotions that cater to customers’ needs. The bank seeks to attract and retain customers by providing cost-effective solutions through these waivers and discounts.

By taking advantage of these offers, customers can save on Imps charges while enjoying the convenience of instant money transfers. Bank of Baroda understands the importance of providing value to its customers, and these offers are just one way in which they strive to meet customer expectations.

Whether it’s for personal or business purposes, utilizing these waivers and discounts can help customers save money and make the most out of their banking experience with Bank of Baroda.

Strategies To Reduce Bank Of Baroda Imps Charges For Regular Mobile Transactions

Bank of Baroda Imps Charges can be reduced by implementing effective strategies for regular mobile transactions. One way to minimize costs is through batch processing, which allows multiple transactions to be grouped and processed together. This increases efficiency and reduces individual transaction charges.

Another strategy is to utilize group payments, where multiple individuals contribute to a single transaction to split the charges evenly. This can help reduce the overall burden on individual users. Additionally, scheduled transfers can be used to optimize timing and minimize transaction frequency, thereby reducing the number of charges incurred.

By implementing these strategies, users can save on Bank of Baroda Imps Charges and conduct mobile transactions more cost-effectively.

Conclusion

Understanding the Bank of Baroda IMPS charges is essential for anyone who frequently conducts online transactions. By taking note of these charges, you can make informed decisions on how to utilize the IMPS service effectively while minimizing costs. Whether you’re transferring funds to friends, paying bills, or shopping online, being aware of the charges associated with each transaction can help you save money in the long run.

Remember to consider the transaction amount, time taken for processing, and any additional fees that may be applicable when using IMPS. By optimizing your usage of the Bank of Baroda IMPS service with this knowledge, you can enjoy the convenience of instant fund transfers without unnecessary expenses.

Stay informed, make smarter choices, and make the most out of your online transactions.